Executive Summary

CHAI Insurance Consulting Group LLC offers a patented insurance program involving “linked” insurance policies that rewards an insured’s improved health. As an insured’s health improves they may gain financial credits which are applied to an account and thereby become eligible to purchase additional insurance (life, dental, homeowners, etc.). If the insured’s health were to decline, then the applied financial credits would revert to the original health insurance policy. The CHAI Insurance Consulting Group LLC welcomes the licensing of their intellectual property portfolio (four patents and six trademarks) to insurance companies (and others) in order to provide the considerable benefits of “linked” insurance for their insureds.

CHAI Insurance Consulting Group LLC owns four patents and six trademarks involved in the patented concept of linked insurance policies. The following quotations are from these patents and can serve to introduce one to the more pertinent concepts concerning this intellectual property:

n = 100,000… n = 1,000,000…

As the etymology of the word insurance has changed during the previous centuries, so also have the various ideas about insurance itself which have recently evolved to include the patented concept of linked insurance policies:

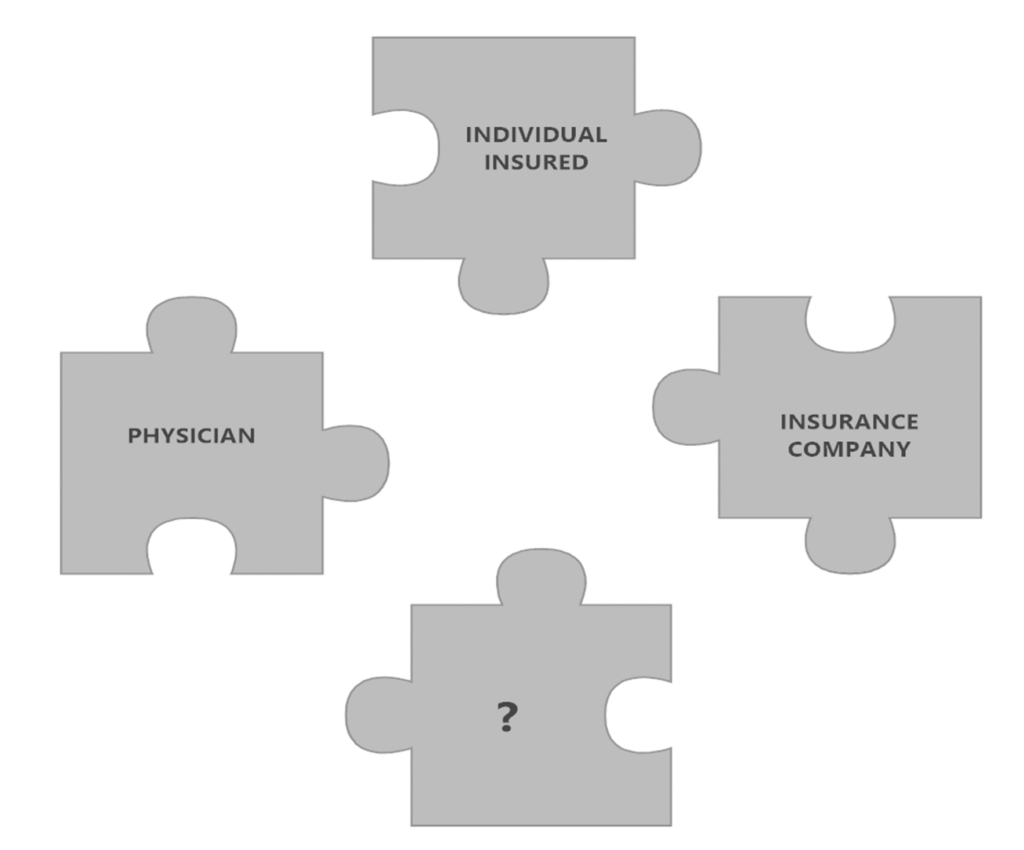

The following diagram can more easily explain the concept of insurance policies becoming linked insurance policies which can function to increase health and wealth.

Raison d’être

The present scenario of health care in the United States typically involves three different entities: the insurance companies, the physician and the insured, each with different sets of goals and priorities and typically at opposite ends of a triangle in a financial and health scenario…

However, while each of these entities should be ideally working together they would also each like to come out on top of the below balance with regard to fiscal and physical health.

Unfortunately, many time the success of one precludes the success of another in this type of scenario.

The net result is that there is an unnecessary compromise of success between all parties involved when there should be a synergistic success.

In essence:

The goal of the insurance company is less expense and greater profitability.

The goal of the insured is health for health insurance policies and longevity for life insurance policies and lower fees.

The role of the physician as “gate keeper” includes: less work, greater pay, less hours of work, greater medical information from more patient testing and greater success for their patients.

It would be ideal if the insured were optimally healthy and could live to 120 present day years in good health…However, this is rarely seen.

It would also be ideal if the physician had the ability to detect virtually all diseases and to be able to apply preventive measures to these diseases within this scenario as well…but this is not the case.

It would be ideal if these two previous ideas were also covered by ones insurance while their insurance company maintains profitability instead of needing to adjust their insurance rates upwards as determined by the increases in: health issues, medical costs, deaths, attrition of policies, etc…

…and to be able to apply all of these advantages for the improved health care or longevity of the insured…but this is not the case either.

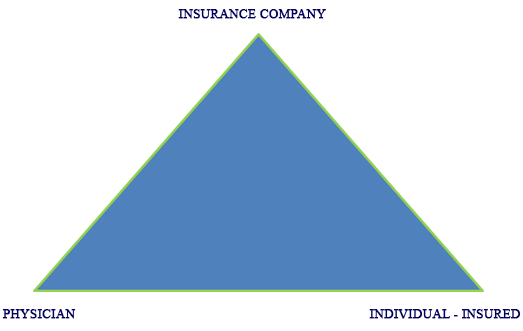

Unfortunately the above scenario represents a: lose – lose – lose situation for each of the three components of the triangle as per what may actually be gained.

That is, presently, neither the physician, insurance company nor the individual / insured are able to optimize the potential resources of each of these entities to their greatest advantage for the benefit of any or all of these entities of the triangle below.

Nowhere is this more obvious than in the quintessential age old paradox or puzzle that can be simply stated as:

Q: How does one win the bet on themselves and their life insurance policy at the same time?

Q: …and more contemporarily…how does one keep themselves healthy and alive and their health and / or life insurance policy viable, in view of the ever spiraling rate of health costs and mortality fees and other expenses as both the insured and the policy age ?

Figure 1 CHAI Insurance Consulting Group LLC

AGE OLD PARADOXICAL INSURANCE TRIANGLE

…and the eventual winner is ?

Insurance Company ?…Physician ?…Individual – Insured?

In order to solve this paradox or puzzle, a new type of thinking is required:

WHAT IS NEEDED TO SOLVE THIS PUZZLE OR PARADOX?

New Ideas – New Concepts

New Thinking – New Solutions

New Products – New Paradigm

A: What is needed is a means for maintaining and improving the client’s health so that a minimum number of health related expenses are incurred for each patient and such that the health insurance company can also thrive.

A: What is needed is for the life insurance industry to create an insurance product that would function as a Life-BeneFIT™ in effect rewarding longevity instead of offering the insured a “viatical settlement” * or “life settlement” **.

A: What is needed is a way for both of these products, life insurance and health insurance, to be merged into one life-health insurance product.

A: What is needed finally is an insurance policy that also behaves as a financial product and yields a positive rate of return on the best investment of all, oneself and one’s family. In this way the insurance company and the client can both share in their respective fiscal and physical health while betting on the same side for the first time.

* A viatical settlement is generally an offer from a third party to purchase a life insurance policy for a reduced amount than the face value (but more than the cash surrender value) typicially occurring when an insured has a terminal diagnosis from a physician and less than two to four years to live.

** A life settlement is generally an offer from a third party to purchase a life insurance policy for a reduced amount than the face value (but more than the cash surrender value) but without the insured having a terminal diagnosis from a physician.

A viatical and life settlement may also have different tax structures.

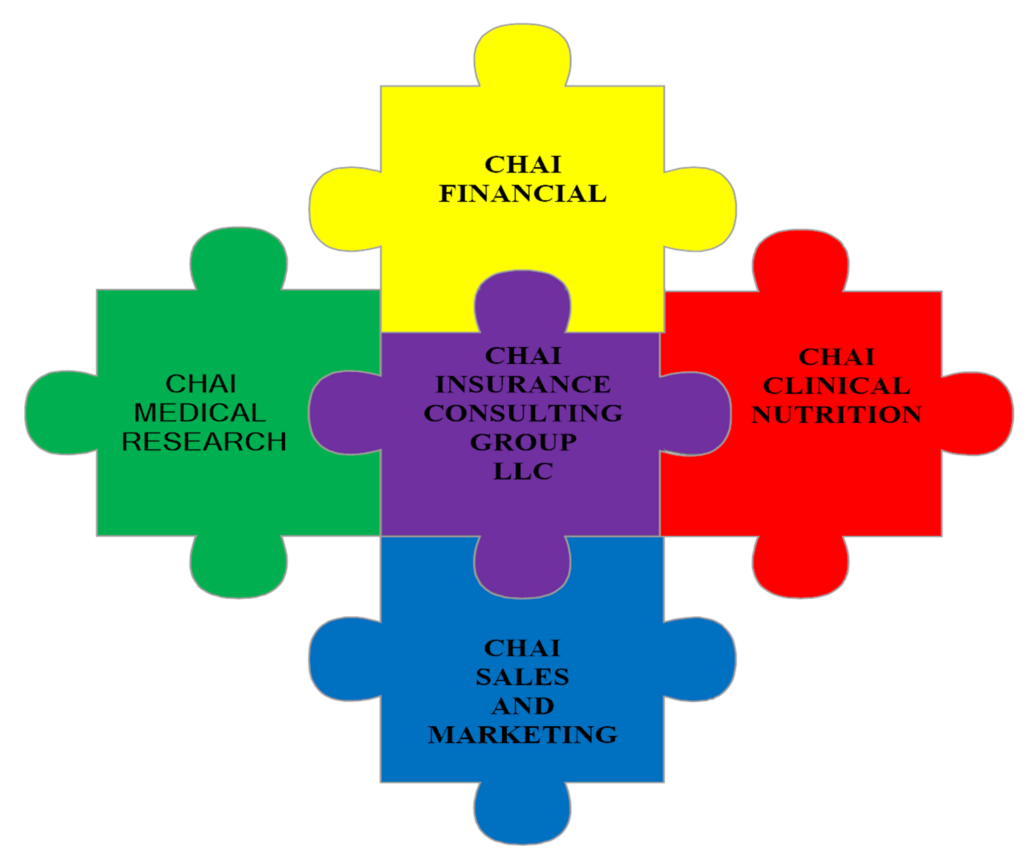

Introducing the CHAI Insurance Consulting Group LLC:

The CHAI Insurance Consulting Group LLC solves this age old paradox of the above triangle by the creation of a new pyramid below.

The CHAI Insurance Consulting Group LLC is the first insurance entity to integrate the benefits of: medicine, clinical research, biomedical science, nutrition, and finance, in order to create a patented insurance product to solve the age old paradigm of health vs wealth.

By linking life insurance with health insurance…one can now develop a new type of insurance product that can yield a win- win- win situation for the: insurance company, the physician and the insured – individual.

Thus the necessity of new thinking and new ideas has yielded the inception of new concepts, new solutions and new product(s)…… and the first insurance products that patentably link “health and wealth”.

Figure 4 CHAI NUTRITIONAL PYRAMIND OF HEALTH

PYRAMID SOLVING TRIANGLE